Debt Collection Agency - Questions

Wiki Article

The Basic Principles Of Debt Collection Agency

Table of ContentsSome Ideas on Dental Debt Collection You Need To KnowPersonal Debt Collection - QuestionsFascination About Private Schools Debt CollectionExamine This Report on Dental Debt CollectionThe smart Trick of Business Debt Collection That Nobody is Talking About

You can ask a collection agency to stop contacting you and dispute the debt if you think it's unreliable.: concur to a payment strategy, wipe it out with a solitary payment or work out a negotiation.

If you do not have an attorney, the agency can contact other individuals just to learn where you live or function. The collection agency can not tell these individuals that you owe cash. The collection firm can get in touch with one more individual just once. These same guidelines apply to exposure to your company.

It can, but does not need to accept a deposit plan (Business Debt Collection). A collection agency can ask that you compose a post-dated check, however you can not be called for to do so. If you offer a debt collection agency a post-dated check, under government regulation the check can not be deposited before the date written on it

The most effective financial debt collection agency job descriptions are succinct yet compelling. Offer details concerning your business's values, goal, as well as culture, and also allow candidates know just how they will certainly add to the company's growth. Think about using bulleted lists to enhance readability, including no greater than 6 bullets per area. When you have a strong initial draft, assess it with the hiring supervisor to make sure all the details is precise as well as the requirements are purely crucial.

See This Report on Business Debt Collection

The Fair Debt Collection Practices Act (FDCPA) is a government regulation enforced by the Federal Trade Commission that safeguards the rights of customers by restricting certain methods of debt collection. The FDCPA applies to the methods of financial obligation collection agencies and also attorneys. It does not apply to lenders that are attempting to recuperate their own debts.

The FDCPA does not use to all debts. As an example, it does not relate to the collection of business or corporate debts. It just puts on the collection of debts a private customer incurred mainly for personal, family, or family functions. Under the FDCPA, a financial debt collector should adhere to certain procedures when speaking to a customer.

It is not intended to be legal advice concerning your particular issue or to replacement for the guidance of an attorney.

The Best Guide To Dental Debt Collection

Personal, household and household debts are covered under the useful site Federal Fair Financial Debt Collection Act. This includes money owed for clinical treatment, revolving charge account or cars and truck purchases. Business Debt Collection. A financial debt enthusiast is anyone apart from the financial institution that regularly gathers or tries to collect debts that are owed to others as well as that resulted from customer dealsOnce a financial debt collection agency has actually notified you by phone, he or she must, within 5 days, send you a composed notice exposing the weblink quantity you owe, the name of the creditor to whom you owe money, as well as what to do if you contest the debt. A financial debt collection agency might NOT: bug, suppress or abuse any individual (i.

You can quit a financial debt collection agency from contacting you by composing a letter to the debt collection agency informing him or her to stop. Once the agency gets your letter, it may not call you once more other than to alert you that some specific activity will be taken. A financial obligation collector may not contact you if, within 1 month after the collector's first get in touch with, you send the collection agency a letter stating that you do not owe the cash.

:max_bytes(150000):strip_icc()/tactics-for-paying-off-debt-collections-960596-final-dd5c75985b904e46b8d1bd8e0a9f4d77.jpg)

The Ultimate Guide To Business Debt Collection

This product is available in alternating format upon request.

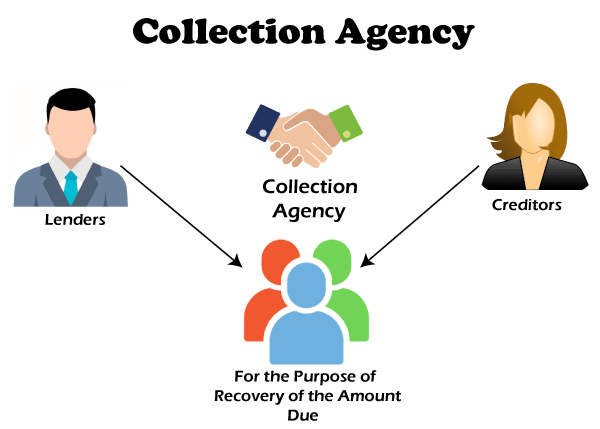

Rather, the lender could either get a firm that is hired to accumulate third-party financial debts or sell the financial debt to a collection agency. Once the financial debt has actually been sold to a financial debt debt collector, you may start to obtain phone calls and/or letters from that agency. The financial debt collection market is heavily managed, as well as borrowers have several civil liberties when it pertains to handling costs collection agencies.

In spite of this, debt enthusiasts will try every little thing in their power to obtain you to pay your old financial obligation. A debt enthusiast can be either a private person or an agency. Their job is to collect past due debts from those that owe them. Sometimes described as collection professionals, a private financial debt enthusiast may be accountable for several accounts.

Financial obligation collection agencies are employed by creditors and also are typically paid a percentage of the quantity of the financial obligation they recoup for the creditor. The portion a debt collector charges is typically based on the age of the financial obligation and also the amount of the financial obligation. Older financial obligations or greater debts may take even more time to accumulate, so a debt collection agency could charge a greater portion for accumulating those.

Indicators on Personal Debt Collection You Need To Know

Others work on a backup basis as well as just charge the lender if they are successful in gathering on the financial debt. The debt collection agency enters right into an agreement with the lender to collect a percent of the financial obligation the percentage is specified by the lender. One financial institution may not be prepared to resolve for much less than the full quantity owed, while an additional might approve a settlement for 50% of the financial debt.Report this wiki page